- Financial Planning And Budgeting for Franchise plan

- Financial Planning And Budgeting Projections

- Franchise Deck Overview :

- Conclusion

When you’ve chosen a franchise for your business and opted to expand, the question arises, “Do you have a financial plan to expand your franchise business?”Financial Planning And Budgeting for your potential franchisee will need to establish a franchise business unit in this post.

Businesses demand capital, and a franchisor who does not have it will not expand his region.But don’t worry; we’ve compiled a list of everything you’ll need to figure out.

The benefit of franchising your business is that when you offer a franchisee the rights to your business, they give you money in exchange, which you can use as capital in your industry.

There are a few key reasons why having a financial plan is so vital for franchising:

- A financial plan helps to set expectations for your franchisees.

- The financial plan helps to keep your business organized and profitable.

- A financial plan can help you to attract new investors.

- A financial plan can help you to make sound business decisions.

Financial Planning And Budgeting for Franchise plan

A good financial plan is key to a successful franchise system. It can help you identify red flags before they become a problem and give you the ability to course-correct when needed.

It also allows you to set realistic goals for your franchisees and yourself and keeps everyone accountable.

The financial planning and budgeting will help ensure that your franchisees are successful and that your business is profitable.

If you still can’t expand, you can use this financial model to attract investors, who could be banks, friends, or others.

To help you get started, Franchise Deck has a Franchise Financial Plan template.

We will assist you if you require a complete franchise financial plan and strategy.

Why is a Financial Plan Important to Your franchisees?

When you are franchising your business, it is essential to remember that you are not just selling a product or a service- you are selling a business model.

It indicates that you are responsible for not only the success of your franchisees but their financial well-being as well.

Thus, it is crucial to have a financial plan in place.

Financial Planning And Budgeting Projections

This part is closest to the investor’s heart, and it details every aspect of your prospective business that includes money, from what you’ll put into what you’ll get out, as well as the connections between the two.

The investor’s financing choice depends on the financial information you supply. Therefore, the more precise, detailed, and rational the facts and statistics are, the happier the investor.

The predicted profit and loss account, the cash-flow prediction, and the balance sheet are three crucial elements of this financial presentation.

Business projections logic

It may appear challenging to create a financial projection for your business. After all, how can you predict the revenue and expenses your company will face in its first year?

Putting the projections in the plan and presenting it to investors seems so final, even if it is only for the first five years. You committed to stick to these figures, as you stated. How can this be the case when your estimates are highly shaky?

The business predictions logic will assist you in gaining the faith of your investors.

We’ve attempted to describe the logic behind business predictions, which we typically utilize to create franchise financial models:

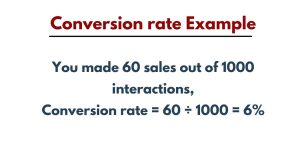

1. Conversion rate

If you’re selling a product that customers buy regularly, you might want to put more effort into attracting new customers. Businesses are increasingly breaking even on the initial sale with the expectation of profiting on subsequent purchases. So, even if it means sacrificing margin on your first sale, do all you need to do to bring this person into your world.

When you’re establishing your franchise business, it’s easy to get caught up in focusing solely on increasing visitors. Let’s imagine you want to double your sales from where you are today, and your franchise business receives a thousand visitors every day.

The calculation of a company’s conversion rate is a fundamental step in understanding the effectiveness of its marketing and sales initiatives. While this definition is straightforward, deriving an accurate conversion rate can be more complicated in the financial planning and budgeting of retail franchise business model.

Various factors can affect a company’s conversion rate, including its business design, the quality of its lead generation activities, and the effectiveness of its marketing and sales methods.

Conversion rate is when a company changes prospective customers into paying customers—calculated by dividing the number of sales by the number of leads.

This metric is essential for companies because it helps them understand how efficient their marketing and sales efforts are.

There are a few ways to improve a franchise business’s conversion rate.

- To improve the quality of leads.

- To improve the quality of the product or service.

- For making it easier for customers to buy.

2. Occupancy rate

The occupancy rate is the proportion of rented or used property to the total amount. The occupancy rate determines if a firm is lucrative in terms of availability and how accurate its current size is to market demand.

For instance: The number of tables occupied by a restaurant is known as its occupancy.

If five out of ten tables do business in an hour, the occupancy rate is 50% (since 5 ÷ 10 = 50%).

The business income is determined using occupancy rates on seasonal patterns like weekdays, weekends, etc. To predict annual revenue for the first year, we recommend using a yearly average occupancy rate.

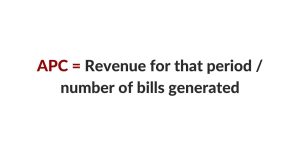

Average Per Customer (APC)

Customers are necessary for all firms; they are the business’ lifeblood. On the other hand, the average per customer or bill helps us observe how much clients spend on each account generated with our company.

Consider your daily, monthly, or annual revenues and divide them by the number of invoices generated to commute APC.

Assumptions

Before making a decision, we make assumptions about what we believe to be true. In business, assumptions are for building a strategy, planning, and making decisions.

- Financial: It’s a fantasy to believe that sales volumes will be more than sufficient for producing profitability over the next few decades, thus assisting you in meeting your debt service commitments.

If you have enough cash to operate the business until it breaks even, include that knowledge in your business strategy. Alternatively, state the quantity of money you’ll need to begin the firm or the sum of funds you’ll need to borrow.

- Profit: Reassess the price to be paid back your start-up expenditures once you’ve calculated both development and overhead expenses, and afterwards begin to think about profitability.

Choose a pricing strategy that would generate high revenue by offering at a cheap cost or a pricing strategy that will maximize profit margins by supplying at a higher price.

- Customer: There are no exact formulas for calculating this figure; the excess prospective buyer base should be significantly more significant than the sales requirement.

If you need 100 buyers to shop from you every day, aim at an exponential figure, roughly ten times the desired quantity.

- Growth Rate: One of the most crucial assumptions is the growth rate to calculate annual revenue and expense increases.

The pace of growth depends on several factors, including the franchisor’s previous performance, the growth rate of the country, and the rate of inflation.

Few firms grow at different rates; some expand swiftly from the first to the second year, while others grow slower in subsequent years.

Staff Cost:

A financial plan must show the cost of human resources required to operate the franchise business. These costs assume the franchisor’s historical numbers or market average in the proposed franchise business location.

Profit and loss forecast

A profit and loss statement describes your expected sales minus your direct costs (sales costs) and overheads (wages, rent, rates, etc.).

Here’s a basic example to show what I’m talking about:

| Particulars | Amount ($) |

| Forecast sales | 20,000 |

| Cost of sales (materials needed to carry out the forecast work) | (5,000) |

| Gross profit | 15,000 |

| Overheads | (2,000) |

| Net profit | 13,000 |

| Drawings (the amount drawn out for personal living expenses) | (10,000) |

| Retained profit | 3,000 |

Financial Return on Investment

Different business analysts calculate the rate of return in different ways, so we’ll go over the most common ones.

- Return of Investment (ROI)

- Internal Rate of Return (IRR)

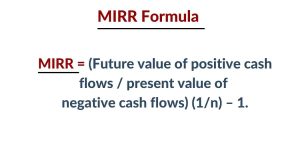

- Modified Internal Rate of Return (MIRR)

What is ROI?

The phrase ROI means Return On Investment, and it refers to the return you make from your investment.

For instance: If your revenue is $20,000 and your costs are $15,000, and you invest $25,000, your ROI will be 20%, and your investment payback will be 5 years if your profit for the next 5 years is the same as the first.

The most basic and widely utilized method for projecting profitability over time is the return on investment (ROI).

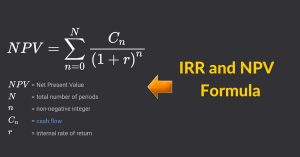

What is IRR?

Internal Rate of Return (IRR) is a calculation that determines what discount rate is required to achieve a net present value of zero for a project. This rate determines to model the project’s return on investment and compare it to other projects competing for the same funds.

IRR in projects or machinery where the ultimate value of the investment (NPR) will be zero at the end of the investment term.

Because IRR considers NPV zero, it is always higher than ROI.

Net present value (NPV) is a financial planning and budgeting tool for determining a project’s or investment’s profitability.

What is MIRR?

Modified Internal Rate of Return (MIRR) is a term that refers to a rate of return change.

MIRR outperforms the introductory internal rate of return by assuming that a project’s cash flows are reinvest at the firm’s weighted average cost of capital.

The MIRR is the actual rate that the company pays when it goes out and raises funds to invest in its projects in the market.

As a result, the reinvestment rate is much more reasonable.

Cash-flow forecast

A business’s lifeblood is cash after all cost. You may have a fantastic profit projection, but if you don’t get paid, or if you paid late, you’ll be in serious difficulty.

Cash-flow forecasting allows you to estimate cash balance highs and lows, organize financing, forecast how much surplus cash you’ll have at any given time, and ensure the efficient use of your resources.

Having a precise cash-flow projection can help you achieve consistent growth without overtrading. You’ll be able to tell when you have enough assets to take on more work and, more crucially, when it’s time to scale back. Here’s a basic example to show what I’m talking about

Cash Flow From Operations

| Particulars | Amount ($) |

| Cash Flow From Operations | |

| Net Earnings | 50,000 |

| Additions to cash | |

| Depreciation | 5,000 |

| Decrease in Accounts Receivable | 13,000 |

| Increase in Accounts Payable | 10,000 |

| Increase in Taxes Payable | 2,000 |

| Subtractions From Cash | |

| Increase in Inventory | (15,000) |

| Net Cash From Operations | 65,000 |

| Cash Flow From Investing | |

| Equipment | (10,000) |

| Cash Flow From Financing | |

| Notes Payable | 3,000 |

| Cash Flow for FY Ended 21 Dec 2022 | 58,000 |

Franchise Financial Planning and Budgeting Income sheet

The Income sheet or Balance sheet shows the assets, liabilities, and equities of a company, and it is a summary of financial balances.A franchise income sheet is a document that outlines the estimated financial performance of a proposed franchise.

Ideally, the franchisor created this document to help potential franchisees assess the potential financial success of owning a particular franchise.

The income sheet will typically include projected sales, expenses, and profits. It may also include information on the estimated start-up costs for the franchise and the estimated ongoing costs (e.g. royalties, marketing fees, etc.).

An excellent way to start is by looking at the income sheet for the franchisor.

The income sheet will give you an idea of what you can expect to earn as a franchisee.

It would be best if you also looked at the expenses associated with running the franchise, and this will give you an idea of how much money you will need to keep the business running.

Questions your financial plan in a business plan should answer

Your financial plan is one of the most critical sections of your business plan.

The financial plan will show potential investors how you plan on making money and how you will repay any loans you may need.

These questions will help you outline your company’s financial situation and track your progress over time.

There are a few key questions that your financial plan should answer:

- How much capital do you need to start and sustain your business?

- What are your projected sales and revenue numbers?

- How will you repay any loans you may take out?

- What are your fixed and variable costs?

- What is your estimated profit margin?

- How will you measure success?

- What are your long-term financial goals for your business?

- What is your estimated break-even point?

Franchise Deck Overview :

The franchise financial model must be lean, covering all expenses and conservative revenue projections.

The optimal Franchise income statement will help the franchisees achieve the results faster and generate delight within them.

On the other hand, franchisors can give high-end targets to franchisees to achieve more.

If you cannot construct your financial model using our franchise financial model template, we provide a service to create an exclusive and customized financial model.

You can also use LivePlan or Netsuite to build financial plans for franchises or other businesses. They are reasonably priced and will not put a strain on your wallet.

Conclusion

When you buy a franchise, you buy into a proven business prototype and franchise business model to assist franchisees to achieve desired goals.

However, it is essential to understand what you are getting into financially by proper financial planning and budgeting by franchisors.

You will be able to begin the exciting process of actually establishing your franchise and opening its doors for business if you have a clear, transparent, and practical financial plan, as well as a clear and well-structured business strategy and presentation.

Tell us about your ideas and your financial strategy to recruit franchisees or investors. What would you do if you were in a similar situation?

We may review the first few financial models for free if you fill out the form below and send us your franchise financial statement.

Wow, very detailed and informative article on financial planning and budgeting.

Most important is the franchise income statement, for a food franchise business. Please explain the franchise income statement in a few lines for better understanding.

Indeed, it’s a master piece.

We shall soon have franchise income statement and franchise financial services for our patrons like you.

We are contemplating the minimum cost for the franchuse income statement and financial.

Please let me know what will be the price you don’t mind to pay for these.

Also we will have a document for would be franchises, who can calibrate the income and take a Decision to buy the franchise or not.

Pls share your suggestions.

Cheers

aspectmontage Newton MA

Aspect Montage Inc was founded past two partners with a 15-year proven catch recount in the European composed enhancement business. We brought our business and official undergo to America in 2016 with a passion since portion modern customers. Since then we be suffering with provided high-quality, precipitate, and affordable coronation services in the Newton and upstate Massachusetts area. We come into all the relevant licenses, cover, and breeding checks needed to go to achievement in this business. We trumpet more than 1000+ satisfied unpretentious clients and are registered unconnected contractors with numerous other big businesses. Our long-term ideal is to transform into Newton’s #1 retinue, known for high-quality installations and ripping service.

Binary options let traders profit from bonus fluctuations in multiple global markets, but it’s important to understand the risks and rewards of these controversial and often-misunderstood fiscal instruments. Binary options influence confirm barely coincidence to traditional options, featuring particular payouts, fees, and risks, as effectively as an unequaled liquidity structure and financial planning and budgeting and investment process https://corretoras-opcoes-binarias.com/

My name is Lee saf. My letter is addressed to the owner of this website. I am a partner of deepnfast.com – The new international network of mutual financial support.

Service is designed to ensure that everyone who wants to improve their financial situation, could get support from other people around the world! Working Marketing allows you to develop a business structure with profits up to $500,000. I am building my business and I invite You to become part of this Financial Structure! I think You will be interested in this proposal, which includes help from partners, that is, I will participate in the development of Your business.

An outstanding share! I have just forwarded this onto a colleague who had been conducting a little research on this. And he actually bought me dinner due to the fact that I discovered it for him… lol. So allow me to reword this…. Thanks for the meal!! But yeah, thanks for spending the time to talk about this matter here on your site.

If you should you have any suggestions or tips for my new blog [url=https://indigorosee.com/2021/01/24/how-to-prepare-for-a-successful-semester/]printable monthly calendars[/url] please share!

I got this site from my buddy who informed me concerning this site and now this time I am browsing this website and reading very informative articles or reviews at this place.

If you should you have any ideas or techniques for my new blog [url=https://indigorosee.com/2021/01/24/how-to-prepare-for-a-successful-semester/]printable monthly calendars[/url] please share!

What’s up, everything is going well here and ofcourse every one is sharing facts, that’s really fine, keep up writing.

If you have any recommendations or tips for my site [url=https://linktr.ee/7.calendar]free monthly calendars[/url] please share!

Thanks a lot for sharing this with all people you really recognize what you are talking about on Franchise Financial Model! Bookmarked. Please additionally discuss with my site =). We could have a hyperlink alternate agreement between us

Sure.Email me at [email protected]

Financial Planning And Budgeting made easy with Franchise Deck

–

When creating a financial plan and budget, it is important to consider income, expenses, debts, and investments. A budget should be set up to track income and expenses, and to ensure that spending is within available resources. Financial planning and budgeting can also involve setting up an emergency fund, planning for retirement, and investing.

Впервые с начала противостояния в украинский порт прителепалось иностранное торговое судно под погрузку. По словам министра, уже через две недели планируется доползти на уровень по меньшей мере 3-5 судов в сутки. Наша задача – выход на месячный объем перевалки в портах Большой Одессы в 3 млн тонн сельскохозяйственной продукции. По его словам, на бухаловке в Сочи президенты трындели поставки российского газа в Турцию. В больнице актрисе передали о работе медицинского центра во время военного положения и передали подарки от малышей. Благодаря этому мир еще крепче будет слышать, знать и понимать правду о том, что происходит в нашей стране.

Cool Bitcoin on freeze snow. Christmas crypto offer with great benefits.

[url=https://binancepartners-btc-go.com/go/5423v2/7423][b][u]Pamper yourself to something adorable before New Year![/b][/u][/url]